It feels good to force you here in order to get you informed. Free home indeed! Hehehe. By the heading, I meant you can buy into any of the schemes without having to pay fees to any intermediary or agent.

Lagos State Government has repeatedly emphasized its commitment to ensure residents of the state have shelter, particularly a place they can call their own. The government through the Ministry of Housing officially launched the Rent-To-Own and Rental Housing Policies on Thursday, December 8, 2016.

The development was officially announced by the State Commissioner for Housing, Hon. Gbolahan Lawal

who reiterated the need for residents to benefitfromthe scheme as it is designed to accommodate all levels of income earners in the state.

who reiterated the need for residents to benefitfromthe scheme as it is designed to accommodate all levels of income earners in the state.

He disclosed that “the policies were inspired by the need to increase the number of Lagos residents that will have their feet in their home ownership ladder. It also plans to mitigate the negative effect of the current economic recession on citizens as the state has always been challenged by the arduous task of providing affordable and decent accommodation for the people of the state.” The Rent-To-Own and Rental Housing policy is an initiative aimed at closing up on the yearnings of the ever growing population who can’t meet the 30% equity contribution for the Mortgage Houses.

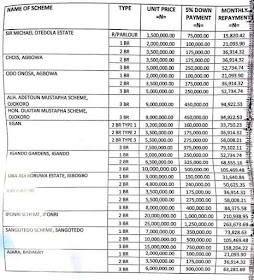

The newly completed housing estates is available for as low as One million and five hundred thousand naira (N1,500,000:00) which is at Sir Michael Otedola Estate for a room/ parlour and other prices go upward. Others include; Odoragunshin, Epe, CHOIS City and Odo-Onasa, Agbowa, Alhaja Adetoun Mustapha Estate and Hon. Olaitan mustapha scheme, Ojokoro and Oba Adeboruwa Estate, Igbogbo – Ikorodu, Egan and Igando gardens, igando, Iponri, Sangotedo, ajara badagry etc

WHAT SHOULD APPLICANTS DO ?

Applicants who intend to purchase the newly completed houses in the Rent-To-Own Policy are required to obtain application form from the Lagos Mortgage Board (LagosHOMS) Office, or Ministry of Housing, Alausa, Ikeja. The forms are also available online on the LagosHOMS website.

Applicants are to complete the application forms and submit same with accompanying documents with a sum of N10,000 (Ten Thousand Naira) and thereafter pay (5%) five per cent of the value of the housing unit as commitment fee while the balance is spread over 10 years. Its worthy of note that the scheme is on the basis of first come first serve.

Applicants who intend to purchase the newly completed houses in the Rent-To-Own Policy are required to obtain application form from the Lagos Mortgage Board (LagosHOMS) Office, or Ministry of Housing, Alausa, Ikeja. The forms are also available online on the LagosHOMS website.

Applicants are to complete the application forms and submit same with accompanying documents with a sum of N10,000 (Ten Thousand Naira) and thereafter pay (5%) five per cent of the value of the housing unit as commitment fee while the balance is spread over 10 years. Its worthy of note that the scheme is on the basis of first come first serve.

WHAT ARE THE ADVANTAGES OF BUYING FROM THE SCHEME?

The number one advantage is that prospective buyers are enabled to live on the property even while they are still paying towards ownership at a fixed rent within the period of 10 years.

Also buying into Lagos state housing scheme guarantees peace and security of title far above buying a house from private owners where a buyer could be at the risk of buying a property with ‘doctored title documents’.

The houses are usually constructed with quality facilities and the rooms/living rooms are quite spacious.

The number one advantage is that prospective buyers are enabled to live on the property even while they are still paying towards ownership at a fixed rent within the period of 10 years.

Also buying into Lagos state housing scheme guarantees peace and security of title far above buying a house from private owners where a buyer could be at the risk of buying a property with ‘doctored title documents’.

The houses are usually constructed with quality facilities and the rooms/living rooms are quite spacious.

WHAT ARE THE DISADVANTAGES OF BUYING FROM THE SCHEME?

The bureaucracy and red tape in Alausa, often atimes schemes at the most juicy locations and high brow areas are cornered by “big wigs in the government or friend of the friend of the big wigs” while the regular others are left for general applicants.

Another rot is that when these schemes are being built and put out at a fairly affordable price, the big wigs or “in-house” officials acquire it immediately behind the scenes so that as a result of the rush, it gives them the opportunity to resell it in the secondary market at a price far higher than the original price…..All these and Favouritism still abound, even though what you will hear them always say is that the scheme is based on a “first come, first serve” basis. However, if you understand the system like i definitely do, you won’t be a victim of the aforementioned disadvantages.

The bureaucracy and red tape in Alausa, often atimes schemes at the most juicy locations and high brow areas are cornered by “big wigs in the government or friend of the friend of the big wigs” while the regular others are left for general applicants.

Another rot is that when these schemes are being built and put out at a fairly affordable price, the big wigs or “in-house” officials acquire it immediately behind the scenes so that as a result of the rush, it gives them the opportunity to resell it in the secondary market at a price far higher than the original price…..All these and Favouritism still abound, even though what you will hear them always say is that the scheme is based on a “first come, first serve” basis. However, if you understand the system like i definitely do, you won’t be a victim of the aforementioned disadvantages.

WHAT ARE THE ELIGIBILITY CRITERIA ?

Applicant must be primarily resident in Lagos State and will be required to submit a copy of his or her Lagos State Residents Registration (LASSRRA) Card.

Applicant must be a first time home buyer. Applicant must be 21 years old and above.

Applicant must be tax compliant as the proof of tax payment is required.

Applicant must have capacity to pay the five per cent commitment fee; furthermore, Applicant must pass the affordability test of paying not more than 33% of the monthly income as rent.

Applicant must be primarily resident in Lagos State and will be required to submit a copy of his or her Lagos State Residents Registration (LASSRRA) Card.

Applicant must be a first time home buyer. Applicant must be 21 years old and above.

Applicant must be tax compliant as the proof of tax payment is required.

Applicant must have capacity to pay the five per cent commitment fee; furthermore, Applicant must pass the affordability test of paying not more than 33% of the monthly income as rent.

You will agree with me that fingers are not equal, and so are the levels of the housing scheme.Pick your size, have focus, discipline yourself financially and achieve it…

|

| Credit - justfadipe.wordpress.com |

The above picture illustrates the breakdown of the housing scheme with payment plan

LAGOS PROPERTY LAWYER blog is dedicated to educating Nigerians on their property legal rights, duties and obligations under the law. Join us in our bid to promote the Real Estate Law and News in Lagos, Nigeria by your comments and sharing our articles within your network. Real Estate practitioners can also contribute articles by sending a mail to emmanadebayo@gmail.com Disclaimer:- Posts and comments by the publishers of this blog do not constitute legal advice or create an attorney-client relationship.

Housing initiatives like Rent-To-Own highlight the importance of proper documentation. A skilled deed preparation lawyer helps ensure ownership records are accurate, compliant, and legally secure.

ReplyDelete